mypolit.ru

Prices

Halliburton Stock

What is Halliburton Company stock price today? The current price of HAL is USD — it has increased by % in the past 24 hours. Watch Halliburton. Halliburton Co. company facts, information and financial ratios from MarketWatch Real-time last sale data for U.S. stock quotes reflect trades reported. Halliburton Company (NYSE: HAL) announced today net income of $ million, or $ per diluted share, for the fourth quarter of HAL Halliburton Company. Stock Price & Overview · Trading Data. Volume. M. Average Volume (3 months). M · HAL Dividends. Dividend Yield (FWD). %. Halliburton Company (US:HAL) has institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC). Halliburton Co. analyst ratings, historical stock prices, earnings estimates & actuals. HAL updated stock price target summary. See the latest HAL stock price for Halliburton and the NYSE: HAL stock rating, related news, valuation, dividends and more to help you make your investing. Stock quote, stock chart, investment calculator, dividend history, analyst coverage, historical price lookup, earnings estimates. Stock quote, stock chart, investment calculator, dividend history, analyst coverage, historical price lookup, earnings estimates. What is Halliburton Company stock price today? The current price of HAL is USD — it has increased by % in the past 24 hours. Watch Halliburton. Halliburton Co. company facts, information and financial ratios from MarketWatch Real-time last sale data for U.S. stock quotes reflect trades reported. Halliburton Company (NYSE: HAL) announced today net income of $ million, or $ per diluted share, for the fourth quarter of HAL Halliburton Company. Stock Price & Overview · Trading Data. Volume. M. Average Volume (3 months). M · HAL Dividends. Dividend Yield (FWD). %. Halliburton Company (US:HAL) has institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC). Halliburton Co. analyst ratings, historical stock prices, earnings estimates & actuals. HAL updated stock price target summary. See the latest HAL stock price for Halliburton and the NYSE: HAL stock rating, related news, valuation, dividends and more to help you make your investing. Stock quote, stock chart, investment calculator, dividend history, analyst coverage, historical price lookup, earnings estimates. Stock quote, stock chart, investment calculator, dividend history, analyst coverage, historical price lookup, earnings estimates.

Does Halliburton have a Direct Purchase Plan or Dividend Reinvestment Plan? Yes, the program enables participants to directly purchase Halliburton common shares. The latest closing stock price for Halliburton as of September 06, is · The all-time high Halliburton stock closing price was on July 23, Halliburton Share Price Live Today:Get the Live stock price of HAL Inc., and quote, performance, latest news to help you with stock trading and investing. Up 80% in , Is This Soaring Energy Stock Still a Buy? The near-term prospects look excellent for Halliburton. Discover real-time Halliburton Company Common Stock (HAL) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Halliburton Company stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Up 80% in , Is This Soaring Energy Stock Still a Buy? The near-term prospects look excellent for Halliburton. The Halliburton Company stock price today is What Is the Stock Symbol for Halliburton Company? The stock ticker symbol for Halliburton Company is HAL. Is. Halliburton Company (mypolit.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Halliburton Company | Nyse: HAL | Nyse. Halliburton Co. · PM, Join thousands of traders who make more informed decisions with our premium features. · PM, Upgrade to FINVIZ*Elite to get real-. Halliburton Co. ; Market Value, $B ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), ; Dividend Yield, %. Halliburton (HAL) reachead $ at the closing of the latest trading day, reflecting a % change compared to its last close. View Halliburton Company HAL stock quote prices, financial information, real-time forecasts, and company news from CNN. Get the latest Halliburton Company (HAL) stock price, news, buy or sell recommendation, and investing advice from Wall Street professionals. Halliburton Co. engages in the provision of services and products to the energy industry related to the exploration, development, and production of oil. Based on 15 Wall Street analysts offering 12 month price targets for Halliburton in the last 3 months. The average price target is $ with a high forecast. Halliburton Share Price Live Today:Get the Live stock price of HAL Inc., and quote, performance, latest news to help you with stock trading and investing. Halliburton Company (US:HAL) has institutional owners and shareholders that have filed 13D/G or 13F forms with the Securities Exchange Commission (SEC). View Halliburton Company HAL investment & stock information. Get the latest Halliburton Company HAL detailed stock quotes, stock data, Real-Time ECN. Get the latest Halliburton Company (HAL) real-time quote, historical performance, charts, and other financial information to help you make more informed.

Cash Money Today

income. Leveraging technology to take on small jobs and tasks can help you earn extra cash quickly. “Today's economic environment is anything but stable. Rapid Funding Hit the Bullseye If you're in a bind and need emergency funds fast, you've hit the bullseye with Target Cash Now. Apply Today! How can I get money now? 12 top options · 1. Cash advances · 2. Consider exploring personal loans · 3. Credit builder loan · 4. Borrow money from family and. If you are desperately in need of getting paid today, you may want to look into a cash advance. While I typically do not promote this idea, these are the best. Get up to $4,* cash today! Check Advance Loans. We'll You can use that money to meet emergency needs or pay unexpected bills. Looking for quick cash loans online with money paid today? Apply for a Cash Today loan in minutes, get approved in hours. Find out more! When you need cash today there aren't many options - especially if you have less than perfect credit. Let LoanNow help you with all your cash needs! Store. View All · Buy Now. 20TH ANNIVERSARY BLACK HOODIE. Buy Now. CASH MONEY Subscribe me to the Cash Money Records newsletter Subscribe me to the Cash Money. Apply online for a quick lending decision and if approved, receive instant cash. Speedy Cash offers a variety of fast loans to meet your cash needs. income. Leveraging technology to take on small jobs and tasks can help you earn extra cash quickly. “Today's economic environment is anything but stable. Rapid Funding Hit the Bullseye If you're in a bind and need emergency funds fast, you've hit the bullseye with Target Cash Now. Apply Today! How can I get money now? 12 top options · 1. Cash advances · 2. Consider exploring personal loans · 3. Credit builder loan · 4. Borrow money from family and. If you are desperately in need of getting paid today, you may want to look into a cash advance. While I typically do not promote this idea, these are the best. Get up to $4,* cash today! Check Advance Loans. We'll You can use that money to meet emergency needs or pay unexpected bills. Looking for quick cash loans online with money paid today? Apply for a Cash Today loan in minutes, get approved in hours. Find out more! When you need cash today there aren't many options - especially if you have less than perfect credit. Let LoanNow help you with all your cash needs! Store. View All · Buy Now. 20TH ANNIVERSARY BLACK HOODIE. Buy Now. CASH MONEY Subscribe me to the Cash Money Records newsletter Subscribe me to the Cash Money. Apply online for a quick lending decision and if approved, receive instant cash. Speedy Cash offers a variety of fast loans to meet your cash needs.

Store. View All · Buy Now. 20TH ANNIVERSARY BLACK HOODIE. Buy Now. CASH MONEY Subscribe me to the Cash Money Records newsletter Subscribe me to the Cash Money. Apply for an online cash loan from mypolit.ru today and get the money you need as soon as tomorrow*. Borrow on your own terms with a 5-day risk-free. Store. View All · Buy Now. 20TH ANNIVERSARY BLACK HOODIE. Buy Now. CASH MONEY Subscribe me to the Cash Money Records newsletter Subscribe me to the Cash Money. Can I get an instant cash loan today? If you need money quickly, a cash loan is often the fastest way to receive funds. Access to online banking and faster. How to get money now · 1. Borrow money · 2. Find a side gig · 3. Sell your stuff · 4. Seek assistance from non-profit organizations · 5. Request a payroll. When your funds are tight before payday, a Cash Now line of credit can get you the money you need to pay for unexpected expenses. We're a user-friendly app that provides you with instant funds on your partly cloudy or rainy days. How much money can I borrow? The average Benjy Transfer you. Get the money you need today, start building credit, and set yourself up for a bright financial future. GET STARTED WITH BRIGIT: 1. Download Brigit 2. at first i was able to borrow now i can borrow up to a week! money was deposited into my bank account within the hour. Dave only charges. For example, a digital dollar would pose a danger to the banking system. What if households were to move their money out of regular bank accounts and into. At CashNetUSA, our lines of credit and loans can be a great solution when you need emergency cash immediately. You can apply online in minutes. Meet FloatMe, your Best Financial Friend designed to help you get, manage, and save money. Get fast cash advances directly to your bank account and more by. You suddenly need money for an unexpected expense, opportunity, or life event. What are the most effective and responsible ways to get it? Here are answers. Cash Advance Now loans are designed to assist you in meeting your short-term borrowing needs and are not intended to be a long term financial solution. Examples. You suddenly need money for an unexpected expense, opportunity, or life event. What are the most effective and responsible ways to get it? Here are answers. Here are 12 ways to make money now, increase your income, and help you build an emergency fund. Let's make some quick bucks. I Need Money Now – What Can I Do? Things happen. Sometimes emergency situations spring up out of nowhere and you need money now. What can you do? Here are a few. Hey friend, I wrote an article to which you can start today on making money. I can't say that it would be fast cash but it would be a way to. Get the money you need today, start building credit, and set yourself up for a bright financial future. GET STARTED WITH BRIGIT: 1. Download Brigit 2. With an easy online application and quick loan decision, you could get your cash today! Have your funds direct deposited to your bank account. icon.

The Best Credit Reporting Agency

The big three—Experian, TransUnion and Equifax—collect and organize data to create consumer credit reports. The bureaus don't make lending decisions or. The three nationwide consumer credit reporting agencies, also called credit bureaus, are Equifax, Experian and TransUnion. They compile credit histories on. What's the most reputable/used/accurate credit report bureau to look at? I've got Credit Karma so Transunion and Equifax, and both have me at about a low Experian, Equifax, and TransUnion are the credit bureaus. Though this title sounds official, it simply identifies them as the powerhouse companies among the US. Freeze or lift the freeze on your credit report for free by contacting each of the three major credit reporting agencies. There are three credit agencies: TransUnion, Equifax, and Experian. When you apply for a loan, request an increase on your credit limit or even apply for a new. Best Credit Monitoring Services · Experian IdentityWorksSM · Identity Guard · IdentityForce · ID Watchdog · IdentityIQ · PrivacyGuard · Best Free Credit Monitoring. You know your credit report is important, but the three nationwide consumer reporting companies—Equifax, TransUnion, and Experian—aren't the only companies. We monitor your Equifax credit report, provide you with alerts, and help you recover from ID theft so you can focus on living your financial best. The big three—Experian, TransUnion and Equifax—collect and organize data to create consumer credit reports. The bureaus don't make lending decisions or. The three nationwide consumer credit reporting agencies, also called credit bureaus, are Equifax, Experian and TransUnion. They compile credit histories on. What's the most reputable/used/accurate credit report bureau to look at? I've got Credit Karma so Transunion and Equifax, and both have me at about a low Experian, Equifax, and TransUnion are the credit bureaus. Though this title sounds official, it simply identifies them as the powerhouse companies among the US. Freeze or lift the freeze on your credit report for free by contacting each of the three major credit reporting agencies. There are three credit agencies: TransUnion, Equifax, and Experian. When you apply for a loan, request an increase on your credit limit or even apply for a new. Best Credit Monitoring Services · Experian IdentityWorksSM · Identity Guard · IdentityForce · ID Watchdog · IdentityIQ · PrivacyGuard · Best Free Credit Monitoring. You know your credit report is important, but the three nationwide consumer reporting companies—Equifax, TransUnion, and Experian—aren't the only companies. We monitor your Equifax credit report, provide you with alerts, and help you recover from ID theft so you can focus on living your financial best.

The three major credit bureaus are Equifax®, Experian® and TransUnion®. · Credit bureaus are sometimes called credit reporting agencies or consumer reporting. Information on Credit Report Companies Most of us know or have heard of the three large credit bureaus, Experian, TransUnion, and Equifax, but did you know. Experian is among the global leaders of consumer and business credit reporting. Providing credit data to clients in over countries, they pride themselves in. There are numerous business credit reporting agencies, but the largest and most widely used scores are generated by Dun & Bradstreet, Experian, and Equifax. The list includes the three nationwide consumer reporting companies—Equifax, TransUnion, and Experian—and several other reporting companies that focus on. FICO creates different types of consumer credit scores. There are "base" FICO® Scores that the company makes for lenders in multiple industries to use, as well. FICO provides a single-number credit score, while major credit bureaus like Equifax, Experian, and TransUnion (not covered in this article) offer a more. Under FACTA, consumers are entitled to one free credit report every 12 months from each of the three credit bureaus (Equifax, TransUnion, and Experian). We reviewed 16 of the most well-known credit monitoring services (both paid and free). All of our picks monitor your credit and send alerts on a regular basis. The three nationwide credit bureaus — Equifax, Experian, and TransUnion — have a centralized website, toll-free telephone number, and mailing address so you can. A credit monitoring service will track your credit for changes like new accounts and alert you of any suspicious behavior before any damage is done. The three major credit bureaus are Equifax®, Experian® and TransUnion®. · Credit bureaus are sometimes called credit reporting agencies or consumer reporting. There are three major credit reporting agencies in the United States: Experian, Equifax, and Transunion. These companies collect information and produce reports. A credit monitoring service will track your credit for changes like new accounts and alert you of any suspicious behavior before any damage is done. Also, Experian is the largest of the three credit bureaus, and is used by more lenders than anyone else. I would suggest using Experian or. Best Overall: mypolit.ru · Best for Credit Monitoring: Credit Karma · Best for Single Bureau Access: Credit Sesame · Easiest Sign-Up: NerdWallet · Best. The Top 5 Three-Bureau Credit Monitoring Apps · 1. Aura: Award-winning protection with the fastest fraud alerts · 2. Identity Guard: Household name trusted by. There are three main credit bureaus: Experian, Equifax and TransUnion. CNBC Select reviews common questions about them so you can better understand how they. You know your credit report is important, but the three nationwide consumer reporting companies—Equifax, TransUnion, and Experian—aren't the only companies.

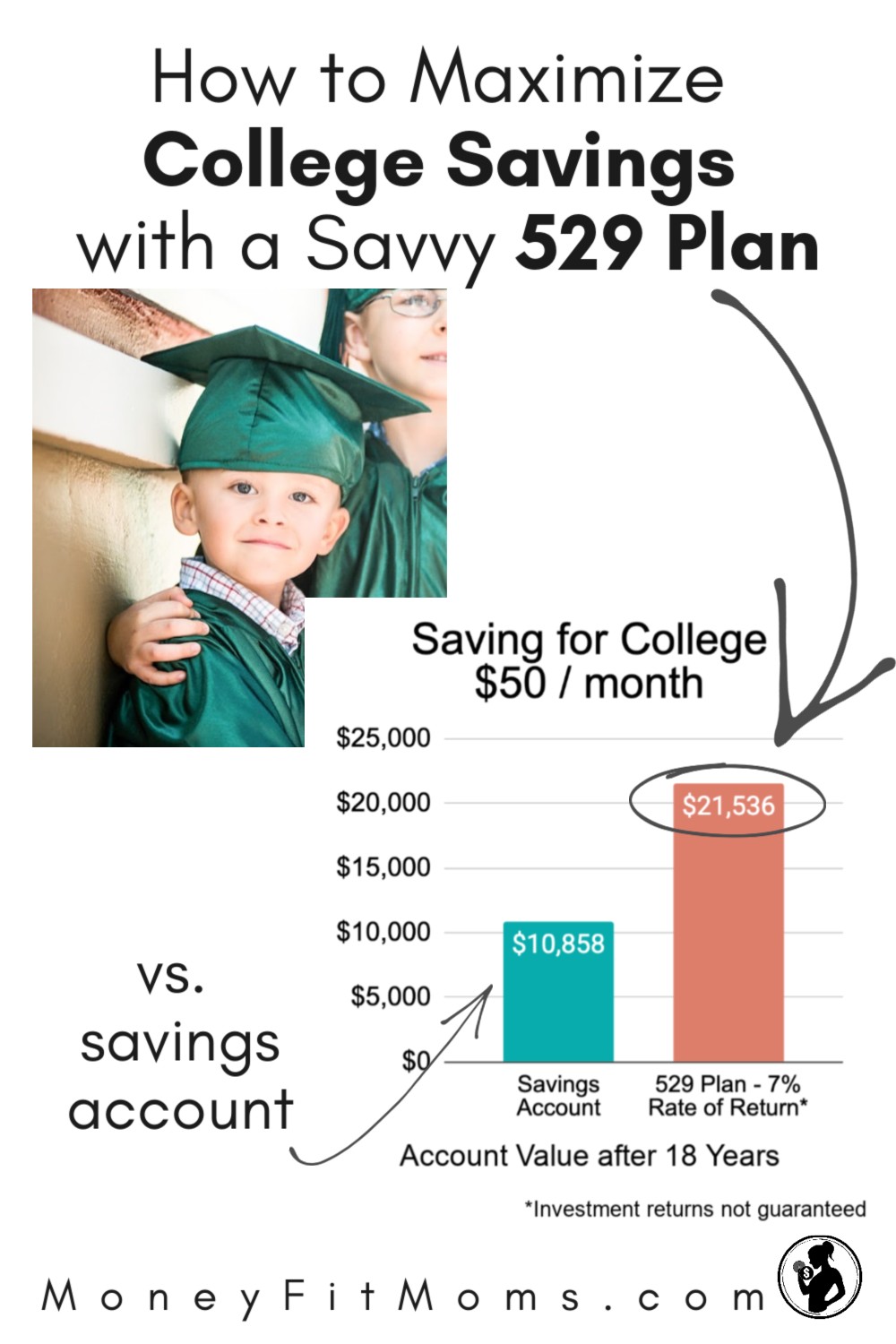

Research 529 Plans

A plan is a tax-advantaged savings plan designed to encourage saving for future education costs. It is important because it offers tax benefits and. Plans: Case Study for State Sponsored. Private Sector Offering. John research/stats/s/s_14_q2. to Q2 CAGR. • Savings Plan = A plan is a tax-advantaged savings plan designed to encourage saving for future education costs. Learn about saving for College: An Introduction to There is no that is self-directed. If it is it's called an Education Savings Account or ESA. They are different. Do the research as your tax. When it comes to investing in a plan, we all have the same goal: to help pay for education. However, everyone's investment strategy can look quite different. The MFS Savings Plan was designed to offer a wide range of investment choices, gifting and estate tax benefits, as well as quality service. Total Amount Saved In Plans: $ Billion · Number Of Plans Opened: Million · Average Plan Balance: $28, · Number Of Children () In The. You may transfer up to a lifetime limit of $35, to a Roth IRA established for a account-designated beneficiary Recent Fidelity studies to help you. Hosted by Paul Curley, CFA, Director of & ABLE Research at ISS Market Intelligence, this webinar provided an overview of the US college financial. A plan is a tax-advantaged savings plan designed to encourage saving for future education costs. It is important because it offers tax benefits and. Plans: Case Study for State Sponsored. Private Sector Offering. John research/stats/s/s_14_q2. to Q2 CAGR. • Savings Plan = A plan is a tax-advantaged savings plan designed to encourage saving for future education costs. Learn about saving for College: An Introduction to There is no that is self-directed. If it is it's called an Education Savings Account or ESA. They are different. Do the research as your tax. When it comes to investing in a plan, we all have the same goal: to help pay for education. However, everyone's investment strategy can look quite different. The MFS Savings Plan was designed to offer a wide range of investment choices, gifting and estate tax benefits, as well as quality service. Total Amount Saved In Plans: $ Billion · Number Of Plans Opened: Million · Average Plan Balance: $28, · Number Of Children () In The. You may transfer up to a lifetime limit of $35, to a Roth IRA established for a account-designated beneficiary Recent Fidelity studies to help you. Hosted by Paul Curley, CFA, Director of & ABLE Research at ISS Market Intelligence, this webinar provided an overview of the US college financial.

When it comes to investing in a plan, we all have the same goal: to help pay for education. However, everyone's investment strategy can look quite different. plans make it easy and affordable to plan ahead for the cost of higher education at colleges & universities, technical & community colleges, trade schools. Explore our plan options that can help you save and pay for qualified education expenses, as well as offering benefits for tax and estate planning. With a direct plan, you'll manage everything yourself, from research to purchasing to monitoring your savings. Advantages include lower fees and certain special. In April , ISS Market Intelligence fielded a survey of more than 1, households and found that % of plan households earn less than $, per. A plan is a college savings plan that allows individuals to save for college on a tax-advantaged basis. Every state offers at least one plan. You can research plans at the College Savings Plans Network website at mypolit.ru If you discover that your plan's performance has been sub-par. Compare only plans where investors purchase directly from the plan manager. You will have to rely on your own research to identify your best options, or you. A plan is a tax-advantaged college savings plan designed to make post-secondary education more affordable for families. Section of the Internal Revenue Code provides for both college savings plans (generally called section plans) maintained by a state, and for prepaid. The Inclusion in College Savings Plans research explores how features of s—including public oversight and outreach, centralized accounting, low deposit. A Plan is a college savings account that is funded by after-tax dollars. However, money invested in a Plan grows tax free. Beneficiaries of the. The MFS Savings Plan was designed to offer a wide range of investment choices, gifting and estate tax benefits, as well as quality service. For more information about the ScholarShare College Savings Plan, call or click here for a Plan Description, which includes investment objectives. Like all savings plans, CollegeAmerica is a tax-advantaged way to save for college tuition and expenses. Your savings plan withdrawals will be free from. money in other states' plans than in the Minnesota College Savings Plan See also House Research short subject, Minnesota's Tax Credit and Deduction for. Withdrawals from your savings plan can be used tax-free for books, computers, room and board, study abroad, and much more. Clearly, there are many ways to. Study abroad expenses such as tuition and fees, program fees, room and board, and required textbooks are eligible to be funded with a plan. Intervention: The study will attempt to increase awareness of, enrollments in, and contributions to College Savings Plans. Using a randomized design. plans are flexible, tax-advantaged accounts designed specifically for education savings. Funds can be used for qualified education expenses at schools.

Java Start

I'm starting to see people say that learning Java is the best path for a beginner and that it'll help when learning other languages to learn that first. To use a Java client with GemFire, you must add the dependencies that are appropriate for your application. Java Web Start is an application-deployment technology that gives you the power to launch full-featured applications with a single click from your Web browser. The Oracle Java License changed for releases starting April 16, The Oracle Technology Network License Agreement for Oracle Java SE is substantially. Chapter 1. Troubleshooting Java Web Start. download. PDF. The Red Hat build of OpenJDK 8 for Microsoft Windows distribution includes an implementation of the. The Java Thread start() method causes this thread to begin execution, the Java Virtual Machine calls the run method of this mypolit.ru result is that two. This tutorial shows you how to write and run Hello World program in Java with Visual Studio Code. It also covers a few advanced features. Try reinstalling the extension pack for Java. If that doesn't help, then follow the instructions to set it up from scratch. Launch the Windows Start menu · Click on Programs (All Apps on Windows 10) · Find the Java program listing · Click Configure Java to launch the Java Control Panel. I'm starting to see people say that learning Java is the best path for a beginner and that it'll help when learning other languages to learn that first. To use a Java client with GemFire, you must add the dependencies that are appropriate for your application. Java Web Start is an application-deployment technology that gives you the power to launch full-featured applications with a single click from your Web browser. The Oracle Java License changed for releases starting April 16, The Oracle Technology Network License Agreement for Oracle Java SE is substantially. Chapter 1. Troubleshooting Java Web Start. download. PDF. The Red Hat build of OpenJDK 8 for Microsoft Windows distribution includes an implementation of the. The Java Thread start() method causes this thread to begin execution, the Java Virtual Machine calls the run method of this mypolit.ru result is that two. This tutorial shows you how to write and run Hello World program in Java with Visual Studio Code. It also covers a few advanced features. Try reinstalling the extension pack for Java. If that doesn't help, then follow the instructions to set it up from scratch. Launch the Windows Start menu · Click on Programs (All Apps on Windows 10) · Find the Java program listing · Click Configure Java to launch the Java Control Panel.

The installation process starts with appearance of Java Setup - Welcome dialog box. Click the Install button to accept the license terms and to continue with. To start from scratch, move on to Starting with Spring Initializr. To Java™, Java™ SE, Java™ EE, and OpenJDK™ are trademarks of Oracle and/or its. It's how a lot of coding tools are run, and it's how we're going to work with Java for now. To open the command prompt, go to the start menu and then type. Setting up a custom Dockerfile. To ensure Gitpod workspaces always start with the correct dependencies, configure a Dockerfile: Create a. Processes can be spawned using a mypolit.rusBuilder: Process process = new ProcessBuilder("processname").start();. It's crucial to understand the distinction between invoking the run() method directly and starting a thread with the start() method. Java Web Start (also known as JavaWS, javaws or JAWS) is a deprecated framework developed by Sun Microsystems (now Oracle) that allows users to start. Start Running Applications #. GraalVM includes the Java Development Kit (JDK), the just-in-time compiler (the Graal compiler), Native Image, and standard. The java and javaw tools start a Java application by starting a Java Runtime Environment and loading a specified class. On AIX, Linux, and Windows systems. Your first step towards becoming a Java Developer: Java Start Program! Develop your Java skills through our self-paced, online, free program. This is why we decided to create OpenWebStart, an open source reimplementation of the Java Web Start technology. Our replacement provides the most commonly used. Spring Quickstart Guide · Step 1: Start a new Spring Boot project · Step 2: Add your code · Step 3: Try it. Java Thread start() Method with Examples on run(), start(), sleep(), join(), getName(), setName(), getId(), resume(), stop(), setId(), yield() etc. Creating a thread in Java is done like this: Thread thread = new Thread(); To start the Java thread you will call its start() method, like this: mypolit.ru();. With Java Web Start software, users can launch a Java application by clicking a link in a web page. The link points to a Java Network Launch Protocol (JNLP). If you are executing a Java program using the command line tools you will type java ClassName and execution will start in the specified class's main method. Running Vespa in Docker · Validate the environment: Make sure you see at minimum 4 GB. · Install the Vespa CLI: Using Homebrew: · Start a Vespa Docker container. I have a Windows server (v) and I've updated java to Corretto jdk_7 and Tomcat to I added Tomcat as a Windows Service. Launch DrJava and make the following customizations: If you receive a Windows Security Alert, click either Unblock or Allow Access. Display line numbers by.

Why Is There A Limit On 401k Contributions

For the tax year , the maximum amount that an employee can contribute to their (k) retirement plan is $23, That is $ more than you were allowed to. The contribution limit for employees who participate in (k), (b), most The amount individuals can contribute to their SIMPLE retirement accounts is. For the tax year , the maximum amount that an employee can contribute to their (k) retirement plan is $23, That is $ more than you were allowed to. The IRS limits the amount employees can contribute to retirement savings plans. The limitations for (k) and (b) plans are expressed as the lesser of a. Starting in , The Act requires solo k catch-up contributions made to the Roth solo k if the self-employed individual earns $, (indexed for. The money isn't included in your taxable income amount, which lowers your overall tax responsibility. Be aware there are annual contribution and income limits;. A higher limit costs them (almost) nothing, but allows the employee to save more for retirement. A higher limit does allow them to gift more. The IRS sets a (k) contribution limit every year. In , the (k) employee contribution limit is $, or $ if you are 50 or older. (k)s make employers look good. A higher limit costs them (almost) nothing, but allows the employee to save more for retirement. For the tax year , the maximum amount that an employee can contribute to their (k) retirement plan is $23, That is $ more than you were allowed to. The contribution limit for employees who participate in (k), (b), most The amount individuals can contribute to their SIMPLE retirement accounts is. For the tax year , the maximum amount that an employee can contribute to their (k) retirement plan is $23, That is $ more than you were allowed to. The IRS limits the amount employees can contribute to retirement savings plans. The limitations for (k) and (b) plans are expressed as the lesser of a. Starting in , The Act requires solo k catch-up contributions made to the Roth solo k if the self-employed individual earns $, (indexed for. The money isn't included in your taxable income amount, which lowers your overall tax responsibility. Be aware there are annual contribution and income limits;. A higher limit costs them (almost) nothing, but allows the employee to save more for retirement. A higher limit does allow them to gift more. The IRS sets a (k) contribution limit every year. In , the (k) employee contribution limit is $, or $ if you are 50 or older. (k)s make employers look good. A higher limit costs them (almost) nothing, but allows the employee to save more for retirement.

Where can I find my IRS Contribution Limits? Here at pensionscom, FMI Retirement Services Long Island New York. Because the saving is tax-favored, the Internal Revenue Code (IRC) limits the amount that employees and employers can contribute. For instance, elective. After contributing up to the annual limit in your (k), you may be able to save even more on an after-tax basis. · Earnings on after-tax contributions are. So, if your salary deferral limit is $23, but your employer adds $5, as a matching contribution, you should still be able to contribute $23, There may. Two annual limits apply to contributions: A limit on employee elective salary deferrals. Salary deferrals are contributions an employee makes. Your limit may increase up to $3, per year, with a lifetime catch-up of $15, This increase is available only if you meet two criteria: You must have at. For (k) and (b) accounts, the contribution limit is $23,, with a $7, catch-up contribution limit for savers 50 and over. · For traditional and. The IRS limits the amount of compensation that determines retirement contributions; for , the limit is $, As an example, a consultant under 50 with. The catch up (k) contribution is set at $6, The contribution limit encourages workers nearing their retirement to accelerate their savings plan. #3. A (k) plan may allow participants to transfer certain amounts in the plan to their designated Roth account in the plan. Contribution Limits. Employer and. The total contribution limit for both employee and employer contributions to (k) defined contribution plans under section (c)(1)(A) increased from $66, In the past, the (k) contribution limits have gone up incrementally, typically about $ each year. For example, in , the contribution limit was $18, Contribution limits are determined by the Internal Revenue Service (IRS) each year. These amounts apply to each plan, allowing you to contribute the maximum. Some companies have their (k) set up to accommodate this very scenario. The contribution limit for (k)'s in is $19, So, if you wanted to. Roth (k) contribution limits. The maximum amount you can contribute to a Roth (k) for is $23, if you're younger than age This is. The (k) contribution limit is $23, in · Workers 50 and older are allowed an additional $7, catch-up contributions. · The overall (k) limits for. The Internal Revenue Service (IRS) maximum contribution limits in (k) and plans for will increase for For , employees may contribute up to $20, into their (k) plan. If they are 50 or older, a catch-up contribution allows an additional $6, to be. The dollar limit can consist of all before-tax, all Roth (after-tax) or a combination of the two. If a participant is contributing to another (k) or a (b). (k) employee contribution limits increase in to $23, from $22, in Those over 50 years of age can make additional catch-up contributions of.

How Much Is The Federal Inheritance Tax

In the United States, the estate tax is a federal tax on the transfer of the estate of a person who dies. The tax applies to property that is transferred by. An inheritance tax is a state tax that you're required to pay if you receive items like property or money from a deceased person. Sometimes referred to as a “death tax,” this federal tax is levied on the transfer of assets once an individual passes away. The estate tax exemption sunset. Utah picks up all or a portion of the credit for state death taxes allowed on the federal estate tax return. Effective January 1, , the state death tax credit has been eliminated. The information below summarizes the filing requirements for Estate, Inheritance, and. As you might guess, only a small percentage of Americans die with an estate worth $ million or more. But for estates that do, the federal tax bill is. Estate and Inheritance Tax Information · 1% tax on the clear value of property passing to a child or other lineal descendant, spouse, parent or grandparent. · 10%. death taxes on the federal estate tax return (Form ). Use the tax table The amount paid to Georgia is a direct credit against the federal estate tax. The estate tax is a tax on your right to transfer property at your death. It consists of an accounting of everything you own or have certain interests in at. In the United States, the estate tax is a federal tax on the transfer of the estate of a person who dies. The tax applies to property that is transferred by. An inheritance tax is a state tax that you're required to pay if you receive items like property or money from a deceased person. Sometimes referred to as a “death tax,” this federal tax is levied on the transfer of assets once an individual passes away. The estate tax exemption sunset. Utah picks up all or a portion of the credit for state death taxes allowed on the federal estate tax return. Effective January 1, , the state death tax credit has been eliminated. The information below summarizes the filing requirements for Estate, Inheritance, and. As you might guess, only a small percentage of Americans die with an estate worth $ million or more. But for estates that do, the federal tax bill is. Estate and Inheritance Tax Information · 1% tax on the clear value of property passing to a child or other lineal descendant, spouse, parent or grandparent. · 10%. death taxes on the federal estate tax return (Form ). Use the tax table The amount paid to Georgia is a direct credit against the federal estate tax. The estate tax is a tax on your right to transfer property at your death. It consists of an accounting of everything you own or have certain interests in at.

Filing threshold for year of death ; , $5,, ; , $11,, ; , $11,, ; , $11,,

Most states have a progressive rate structure (for example, see New York's tax table) with a top estate tax rate of 16 percent, a relic of the previous federal. This is in contrast to the federal estate tax, which is a tax upon the entire amount of property owned by the decedent at the time of death. Inheritance Forms. As with the Maryland estate tax, the federal estate tax provides for portability of any unused unified credit amount. To elect portability, a surviving. federal taxable estate calculated under the provisions of the federal estate tax laws as in effect on the date of the decedent's death. This amount is then. 15 percent on transfers to other heirs, except charitable organizations, exempt institutions and government entities exempt from tax. Property owned jointly. Inheritance tax, also known as death tax or federal estate tax is an important tax talk you'll run into if certain personal property passes down to you. The amount payable depends on the size of the estate. It applies on estates worth $50, or more – $15 for every $1, (or part thereof) of the estate value. As you might guess, only a small percentage of Americans die with an estate worth $ million or more. But for estates that do, the federal tax bill is. federal provisions of portability for estate tax. Each estate is entitled to the applicable exclusion amount based on the decedent's date of death. What. As of January 1, , the New York estate tax exemption amount will be the same as the federal estate tax applicable exclusion amount prior to the Tax Act. When someone dies, their estate might have to pay a federal estate tax. The federal estate tax exemption is now set at over $12 million. Most people need not. The inheritance tax is a tax on a beneficiary's right to receive property from a deceased person. The amount of the inheritance tax depends on the relationship. As of January 1, , the New York estate tax exemption amount will be the same as the federal estate tax applicable exclusion amount prior to the Tax Act. federal provisions of portability for estate tax. Each estate is entitled to the applicable exclusion amount based on the decedent's date of death. What. amount, their estate is responsible for up to a 40% tax. Certain US states impose their own estate and inheritance taxes in addition to federal estate taxes. Estate and gift taxes, the congressional budget office noted, raised only about $ billion in federal revenue in That's about one percent of the more. Kentucky estate tax is equal to the amount by which the credits for state death taxes allowable under the federal tax law exceeds the inheritance tax, less the. For people who pass away in , the exemption amount is $ million (up from $ million last year). Its purpose was to ensure New Jersey receives the full amount of the Credit for State Death Taxes allowed against the Federal Estate Tax. WHAT'S NEW? P.L. The inheritance tax is a tax on a beneficiary's right to receive property from a deceased person. The amount of the inheritance tax depends on the relationship.

How Much To Put Aside For Retirement

A common rule is to budget for at least 70% of your pre-retirement income during retirement. This assumes some of your expenses will disappear in retirement and. If the company kicks in 5%, then you save at least 5%. If your employer does nothing, set aside at least 10% of each paycheck on your own. (If you are older and. Fidelity's guideline: Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by · Factors that will impact your personal savings. Well on the Way to Retirement · Savings Goal: 20%+ of your annual income · Savings Checkpoints: 6x-8x annual salary by age How much of my salary should I save for retirement? To ensure a comfortable future, save at least % of your income annually for retirement. This includes. The 70%-to% Rule states that to keep our standard of living in retirement, we'll need 70% to 80% of present income. Split the difference at 75%. If you. Many experts maintain that retirement income should be about 80% of a couple's final pre-retirement annual earnings. Fidelity Investments recommends that you. It takes planning and commitment and, yes, money. Facts. ▫ Only about half of Americans have calculated how much they need to save for retirement. 1. Aim to save between 10% and 15% of your annual pretax income for retirement. This assumes an approximately to year working career during which you are. A common rule is to budget for at least 70% of your pre-retirement income during retirement. This assumes some of your expenses will disappear in retirement and. If the company kicks in 5%, then you save at least 5%. If your employer does nothing, set aside at least 10% of each paycheck on your own. (If you are older and. Fidelity's guideline: Aim to save at least 1x your salary by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by · Factors that will impact your personal savings. Well on the Way to Retirement · Savings Goal: 20%+ of your annual income · Savings Checkpoints: 6x-8x annual salary by age How much of my salary should I save for retirement? To ensure a comfortable future, save at least % of your income annually for retirement. This includes. The 70%-to% Rule states that to keep our standard of living in retirement, we'll need 70% to 80% of present income. Split the difference at 75%. If you. Many experts maintain that retirement income should be about 80% of a couple's final pre-retirement annual earnings. Fidelity Investments recommends that you. It takes planning and commitment and, yes, money. Facts. ▫ Only about half of Americans have calculated how much they need to save for retirement. 1. Aim to save between 10% and 15% of your annual pretax income for retirement. This assumes an approximately to year working career during which you are.

Key points. Deciding how much to save for retirement can be confusing. Average savings benchmarks can show how you compare with others in your age bracket. Retirement Savings Rule of Thumb. A generally accepted rule of thumb for retirement planning is that you should have, at minimum, 80 percent of the yearly. Having a pension means you may not need to save as much as someone relying solely on (k) investments for their retirement income. If you're just starting out. By starting to put away money earlier, a year-old investing approximately $ per month ($2,/year) accumulates more assets by age 65 than if he or she. You should consider saving 10 - 15% of your income for retirement. Sound daunting? Don't worry: your employer match, if you have one, counts. If you save 5% of. We suggest saving % of your gross income towards retirement. While saving something is better than nothing, especially while you're young or just. If you start saving in your 20s, contributing 10% to 15% of your paycheck (including any savings match from your employer), you'll likely meet your retirement. While an exact percentage will vary based on your individual goals and timeline, a general rule of thumb is to save 10–15% of your pre-tax salary each year for. This rule suggests that a person save 10% to 15% of their pre-tax income per year during their working years. For instance, a person who makes $50, a year. The Cost of Waiting to Save for Retirement · 27 years old? · Start at age 37, and you're putting away $ a month to reach your goal. · Begin at age 47, and. To have sufficient savings for a lifestyle in retirement that covers your annual retirement expenses of $49,, we recommend saving a minimum of $ a month. Each year, the IRS sets limits on how much savers can contribute to their retirement savings accounts. If you're over 50 — or are turning 50 by the end of the. To be able to have 80% of your current income you'd need to save around 25% of your paycheck at minimum for every paycheck u til you retire in. “How much could $1 million or more give you per year? · If the value of investments at age 65 is $1,,, then the projected annual income through age 97*. In general, it's a good idea to set aside 10% to 15% of your income for retirement. (Thanks to compounding, the more time you have toward that goal, the less. Many financial advisors suggest saving 10% to 15% of your gross income, starting in your 20s That's in addition to money set aside for short-term goals, such. The first step is to get an estimate of how much you will need to retire securely. One rule of thumb is that you'll need 70% of your annual pre-retirement. How much money to save by age 40 and 50 · At least three times your salary · Around four times your salary · Six times your salary · Eight times. Number (of months): The number of months is how many months you have to save for retirement. It's calculated by multiplying the number of years between your. How much cash you stow away for retirement is no different. In fact, most financial experts will suggest investing 15% of your income annually in a.

Carshield Better Business Rating

Rob W. 0. 1. 4 months ago. Trustpilot reviews Review of CarShield business with carshield. Helpful 2. Helpful 3. Thanks 0. Thanks 1. Love this 0. Love this. when my washer is finally fixed, I'm filing a complaint with the BBB and leaving detailed reviews on both AHS and A&E anywhere reviews can be. The BBB Rating mypolit.ruve comments were the reason I didn't join. Too many claims rejected. I'm surprised they get Name Brand “Stars" plugging. CarShield has reviews (average rating ). Consumers say: Don't BUY THIS INSURANCE, Horrible company. The BBB Rating mypolit.ruve comments were the reason I didn't join. Too many claims rejected. I'm surprised they get Name Brand “Stars" plugging. Car shield admitted my plan would cover cooling system. Although carshield doesn't have a great rating on the better business bureau bbb website – with only 1. The company has an A rating on BBB, which indicates that the company responds to and attempts to resolve customer concerns. However, its customer score is only. CarShield is not a BBB-accredited business and it has an F rating with the service. They have been in business for 16 years and operate out of Missouri. Their. Do you agree with CarShield's 4-star rating? Check out what people have written so far, and share your own experience. Rob W. 0. 1. 4 months ago. Trustpilot reviews Review of CarShield business with carshield. Helpful 2. Helpful 3. Thanks 0. Thanks 1. Love this 0. Love this. when my washer is finally fixed, I'm filing a complaint with the BBB and leaving detailed reviews on both AHS and A&E anywhere reviews can be. The BBB Rating mypolit.ruve comments were the reason I didn't join. Too many claims rejected. I'm surprised they get Name Brand “Stars" plugging. CarShield has reviews (average rating ). Consumers say: Don't BUY THIS INSURANCE, Horrible company. The BBB Rating mypolit.ruve comments were the reason I didn't join. Too many claims rejected. I'm surprised they get Name Brand “Stars" plugging. Car shield admitted my plan would cover cooling system. Although carshield doesn't have a great rating on the better business bureau bbb website – with only 1. The company has an A rating on BBB, which indicates that the company responds to and attempts to resolve customer concerns. However, its customer score is only. CarShield is not a BBB-accredited business and it has an F rating with the service. They have been in business for 16 years and operate out of Missouri. Their. Do you agree with CarShield's 4-star rating? Check out what people have written so far, and share your own experience.

We have sat through several meetings just to go over our BBB rating and to be blamed for the negative reviews and not one time has this. Omg always check into Carshield, it is owned by American Auto Shield LLC which has an f rating with the BBB. I was in a repair shop when they were talking with. BBB accredited since 3/29/ Auto Service Contract Companies in Saint Peters, MO. See BBB rating, reviews, complaints, & more. This organization is not BBB accredited. Auto Service Contract Companies in Chicago, IL. See BBB rating, reviews, complaints, & more. rating from the Better Business Bureau. CarShield is a legitimate extended car warranty company that has been providing vehicle service contracts for nearly. rating from the Better Business Bureau. CarShield is a legitimate extended car warranty company that has been providing vehicle service contracts for nearly. CarShield customer reviews are generally impressive. The company receives stars out of from more than 1, ratings on Google and it. Cons of CarShield - Low Rating and BBB Warnings: It's important to note that rating and warnings of complaints from the Better Business Bureau (BBB). Compare us against other Vehicle Service Contract Companies ; Extended Car Quotes (AUL Corp). Graded A+ with /5 Customer Rating ; CarShield. Graded F with. CarShield and dozens of other warranty sellers have been awarded “F” grades by the Better Business Bureau (BBB). They've generated thousands of consumer. BBB rating is "F". Numerous complaints, esp roadside help. Check w AAA, much cheaper and better company all around! Customer service was pitiful and unfriendly! The dealership I have my car fixed at let me know that Carshield rarely if ever pays for repairs. DO NOT purchase. CarShield also has strong ratings but tends to receive mixed feedback on its initial high pricing and negotiation tactics. Additionally, CarShield customers. mypolit.ru•50K reviews. · American Dream Auto Protect Trustpilot Business · Products · Plans & Pricing · Business Login · Blog for Business. Follow us. CarShield has a rating of stars from 2, reviews, indicating that most customers are generally satisfied with their purchases. BBB-accredited business with an A+ rating · Instant quotes offered directly on the service website · Unlimited repair claims in a year, with no caps or. CarShield has a rating from Trustpilot, with the overwhelming majority of reviews rating the company as “Excellent.” CarShield is accredited by the Better. In addition to thousands of poor online reviews, CarShield has an F rating with the Better Business Bureau, which is a big red flag. The BBB, an agency that. i love this business ken is the best representative. You might also consider. Sponsored. We need a class action suit started! The BBB has one against them & give them a F rating.

How To Get Certified As An Accredited Investor

Current Accreditation Requirements · To be an individual accredited investor you must either: · To be a joint accredited investor with your spouse you must either. Entities such as trusts must have assets greater than $5 million and be directed by a “sophisticated person” with sufficient financial and business knowledge to. For the net worth criteria, a lot of my worth is in my primary residence (K). Excluding that, it barely hits 1M $. Q2: How do I get certified. The person or the company must achieve specific income and net worth requirements to be considered an accredited investor. For startups, accredited investors. Anyone with SEC or FINRA specified certifications, such as Series 7, 62, or 82, gets automatic accredited investor status. Finally, demonstrate that you are a. Professional Attestations: Letters from CPAs, attorneys, or investment advisors can also vouch for an investor's accredited status, provided. Yes, you apply for a permit and get an ID card. No picture but they take a thumbprint. You must bring in your bank and brokerage statements and. What evidence do I need to provide to prove that I am accredited as a US individual investor? · 1. Income Evidence (this is generally the fastest method for. The individual must have a net worth greater than $1 million, either individually or jointly with the individual's spouse. · The primary residence is not counted. Current Accreditation Requirements · To be an individual accredited investor you must either: · To be a joint accredited investor with your spouse you must either. Entities such as trusts must have assets greater than $5 million and be directed by a “sophisticated person” with sufficient financial and business knowledge to. For the net worth criteria, a lot of my worth is in my primary residence (K). Excluding that, it barely hits 1M $. Q2: How do I get certified. The person or the company must achieve specific income and net worth requirements to be considered an accredited investor. For startups, accredited investors. Anyone with SEC or FINRA specified certifications, such as Series 7, 62, or 82, gets automatic accredited investor status. Finally, demonstrate that you are a. Professional Attestations: Letters from CPAs, attorneys, or investment advisors can also vouch for an investor's accredited status, provided. Yes, you apply for a permit and get an ID card. No picture but they take a thumbprint. You must bring in your bank and brokerage statements and. What evidence do I need to provide to prove that I am accredited as a US individual investor? · 1. Income Evidence (this is generally the fastest method for. The individual must have a net worth greater than $1 million, either individually or jointly with the individual's spouse. · The primary residence is not counted.

What Is an Accredited Investor? · Net worth over $1 million, excluding their primary residence (individually or with spouse or partner). · Income over $, Among the new methods to become an accredited investor is to get professional qualifications, distinctions, or other credentials from an approved educational. As of December 9, , accredited investors can also be certain individuals who can demonstrate financial literacy, know-how, and history in the world of. Due to regulatory restrictions, Bnk To The Future can only accept High Net Worth accredited investors. Under US law, accredited investors can be composed of. Likely the most common way to become a verified accredited investor is by having a certain income level. You can be deemed an accredited investor if you have. What Does “Accredited Investor” Mean? · Has an income above $, (or a couple earning more than $,) in each of the past two years and expects to earn. In the United States, an accredited investor is someone who has earned $, in gross income the last two years ($, if filing with a spouse or partner). PLEASE NOTE THAT THE ISSUER OF THE SECURITY MAY. REQUIRE ADDITIONAL DOCUMENTATION TO BE COMPLETED. By signing below, I certify that: 1. I have directed Scotia. Despite the formal-sounding title, there is no regulatory board that will certify you as an accredited investor. Regulatory organizations, like the Securities. At a minimum, your investors should confirm that they are accredited investors. Typically, this is done by asking your investor to respond to a questionnaire at. There is no formal process that an individual or institution must follow in order to become an accredited investor. The task of verifying whether an individual. An investor can become an accredited investor by meeting certain requirements that the U.S. Securities and Exchange Commission (SEC) has set in place. The. As of December 9, , accredited investors can also be certain individuals who can demonstrate financial literacy, know-how, and history in the world of. Upload. Enter basic personal information and upload the documents ; Verify. Select your basis of Accreditation and submit evidence online ; Certificate. Receive a. Generally, accredited investors include high-net-worth individuals, banks, financial institutions, and other large corporations, who have access to complex and. An accredited investor is a person or entity that is allowed to participate in investments not registered with the SEC. Upload. Enter basic personal information and upload the documents ; Verify. Select your basis of Accreditation and submit evidence online ; Certificate. Receive a. The “Accredited Investor Certificate” is a letter issued by an accountant, CPA, professionals, or investment advisor certifying that a person qualifies as an. If you invest in a publicly fundraising fund, you will need to provide documentation to verify your status as an accredited investor under US securities law.